The best book about analytics for startup that you’ll ever read. I can’t recommend it highly enough for the tech entrepreneur that needs help measuring and improving his startup’s metrics.

Authors: Alistair Croll, Benjamin Yoskovitz

Originally published: 2013

Pages: 440

Genre: Business

Goodreads rating: ⭐️ 4.09/5

👉 Buy Lean Analytics on Amazon

🎧 Listen for free on Everand (plus 1+ million other books)

The Purpose of Analytics in a Startup

Analytics is about tracking the metrics that are critical to your business. Usually, those metrics matter because they relate to your business model— where money comes from, how much things cost, how many customers you have, and the effectiveness of your customer acquisition strategies.

In a startup, you don’t always know which metrics are key, because you’re not entirely sure what business you’re in. You’re frequently changing the activity you analyze. You’re still trying to find the right product, or the right target audience. In a startup, the purpose of analytics is to find your way to the right product and market before the money runs out.

What Makes a Good Metric?

Here are some rules of thumb for what makes a good metric—a number that will drive the changes you’re looking for.

A good metric is comparative. Being able to compare a metric to other time periods, groups of users, or competitors helps you understand which way things are moving. “Increased conversion from last week” is more meaningful than “2% conversion.”

A good metric is understandable. If people can’t remember it and discuss it, it’s much harder to turn a change in the data into a change in the culture.

A good metric is a ratio or a rate. Accountants and financial analysts have several ratios they look at to understand, at a glance, the fundamental health of a company.* You need some, too.

A good metric changes the way you behave. This is by far the most important criterion for a metric: what will you do differently based on changes in the metric?

- “Accounting” metrics like daily sales revenue, when entered into your spreadsheet, need to make your predictions more accurate. These metrics form the basis of Lean Startup’s innovation accounting, showing you how close you are to an ideal model and whether your actual results are converging on your business plan.

- “Experimental” metrics, like the results of a test, help you to optimize the product, pricing, or market. Changes in these metrics will significantly change your behavior. Agree on what that change will be before you collect the data: if the pink website generates more revenue than the alternative, you’re going pink; if more than half your respondents say they won’t pay for a feature, don’t build it; if your curated MVP doesn’t increase order size by 30%, try something else.

Drawing a line in the sand is a great way to enforce a disciplined approach. A good metric changes the way you behave precisely because it’s aligned to your goals of keeping users, encouraging word of mouth, acquiring customers efficiently, or generating revenue.

If you want to change behavior, your metric must be tied to the behavioral change you want. If you measure something and it’s not attached to a goal, in turn changing your behavior, you’re wasting your time. Worse, you may be lying to yourself and fooling yourself into believing that everything is OK. That’s no way to succeed.

Segments, Cohorts, A/B Testing, and Multivariate Analysis

Segmentation

A segment is simply a group that shares some common characteristic. It might be users who run Firefox, or restaurant patrons who make reservations rather than walking in, or passengers who buy first-class tickets, or parents who drive minivans.

On websites, you segment visitors according to a range of technical and demographic information, then compare one segment to another. If visitors using the Firefox browser have significantly fewer purchases, do additional testing to find out why. If a disproportionate number of engaged users are coming from Australia, survey them to discover why, and then try to replicate that success in other markets.

Cohort Analysis

A second kind of analysis, which compares similar groups over time, is cohort analysis. As you build and test your product, you’ll iterate constantly. Users who join you in the first week will have a different experience from those who join later on. For example, all of your users might go through an initial free trial, usage, payment, and abandonment cycle. As this happens, you’ll make changes to your business model. The users who experienced the trial in month one will have a different onboarding experience from those who experience it in month five. How did that affect their churn? To find out, we use cohort analysis.

Each group of users is a cohort—participants in an experiment across their lifecycle. You can compare cohorts against one another to see if, on the whole, key metrics are getting better over time.

A/B and Multivariate Testing

When we’re comparing one attribute of a subject’s experience, such as link color, and assuming everything else is equal, we’re doing A/B testing.

You can test everything about your product, but it’s best to focus on the critical steps and assumptions.

Rather than running a series of separate tests one after the other—which will delay your learning cycle—you can analyze them all at once usinga technique called multivariate analysis. This relies on statistical analysis of the results to see which of many factors correlates strongly with an improvement in a key metric.

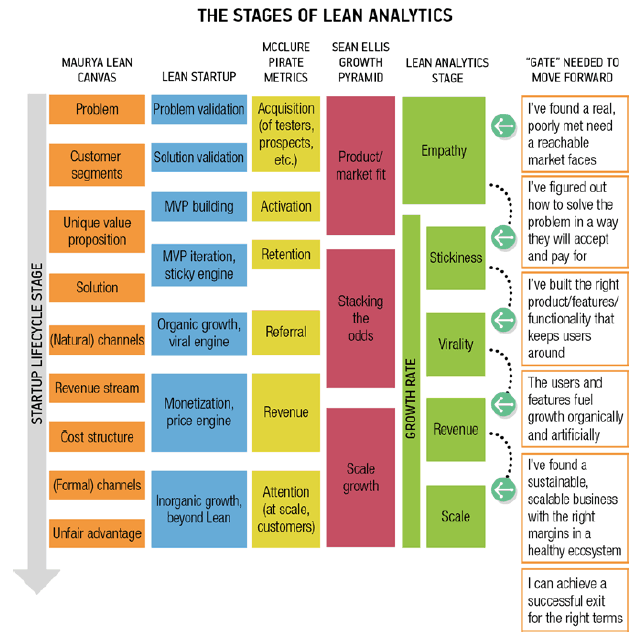

The Lean Analytics Stages and Gates

Having reviewed these frameworks, we needed a model that identified the distinct stages a startup usually goes through, and what the “gating” metrics should be that indicate it’s time to move to the next stage. The five stages we identified are Empathy, Stickiness, Virality, Revenue, and Scale.

Ultimately, there are a number of good frameworks that help you think about your business.

- Some, like Pirate Metrics and the Long Funnel, focus on the act of acquiring and converting customers.

- Others, like the Engines of Growth and the Startup Growth Pyramid, offer strategies for knowing when or how to grow.

- Some, like the Lean Canvas, help you map out the components of your business model so you can evaluate them independent of one another.

Drawing Lines in the Sand

Knowing which metric to focus on isn’t enough. You need to draw a line in the sand as well. Let’s say that you’ve decided “New Customers Per Week” is the right metric to focus on because you’re testing out new ways of acquiring customers. That’s fair, but it doesn’t answer the real question: How many new customers per week do you need? Or more specifically: How many new customers per week (per acquisition channel) do you think defines a level of success that enables you to double down on user acquisition and move to the next step in the process?

You need to pick a number, set it as the target, and have enough confidence that if you hit it, you consider it success. And if you don’t hit the target, you need to go back to the drawing board and try again.

Picking the target number for any given metric is extremely hard. We’ve seen many startups struggle with this. Often, they avoid picking a number altogether. Unfortunately, this means it’s difficult to know what to do once an experiment is completed. If, in our example, the user acquisition experiment is a dismal failure, any number you had picked beforehand is probably immaterial; you’ll know it’s a failure. And if your efforts are insanely successful, you’re going to know that as well. It’ll be obvious. But most of the time, experiments end up right in the big fat middle. There was some success, but it wasn’t out of this world. Was it enough success to keep going, or do you have to go back and run some new experiments? That’s the trickiest spot to be in.

There are two right answers to the question of what success looks like. The first comes from your business model, which may tell you what a metric has to be. If you know that you need 10% of your users to sign up for the paid version of your site in order to meet your business targets, then that’s your number.

The second right answer is to look at what’s normal or ideal. Knowing an industry baseline means you know what’s likely to happen, and you can compare yourself to it. In the absence of any other information, this is a good place to start.

The Five Buttons to Improve for Business Growth

To decide which metrics you should track, you need to be able to describe your business model in no more complex a manner than a lemonade stand’s. You need to step back, ignore all the details, and just think about the really big components.

Business growth comes from improving one of these five “knobs”:

- More stuff means adding products or services, preferably those you know your customers want so you don’t waste time building things they won’t use or buy. For intrapreneurs, this means applying Lean methods to new product development, rather than starting an entirely new company.

- More people means adding users, ideally through virality or word of mouth, but also through paid advertising. The best way to add users is when it’s an integral part of product use—such as Dropbox, Skype, or a project management tool that invites outside users outsiders— since this happens automatically and implies an endorsement from the inviting user.

- More often means stickiness (so people come back), reduced churn (so they don’t leave), and repeated use (so they use it more frequently). Early on, stickiness tends to be a key knob on which to focus, because until your core early adopters find your product superb, it’s unlikely you can achieve good viral marketing.

- More money means upselling and maximizing the price users will pay, or the revenue from ad clicks, or the amount of content they create, or the number of in-game purchases they make.

- More efficiently means reducing the cost of delivering and supporting your service, but also lowering the cost of customer acquisition by doing less paid advertising and more word of mouth.

Segmenting Users

When you get a wave of visibility, few of the resulting visitors will actually engage with your product. Many are just driving by.

The key here is analytics. You need to segment real, valuable users from drive-by, curious, or detrimental ones. Then you need to make changes that maximize the real users and weed out the bad ones.

Segmenting real users from casual ones also depends on how much effort your users have to put into using the application.

As a startup, you have a wide range of payment and incentive models from which to choose: freemium, free trial, pay up-front, discount, ad-funded, and so on. Your choice needs to match the kind of segmentation you’re doing, the time it takes for a user to become a paying customer, how easy it is to use your service, and how costly an additional drive-by user is to the business.

Not all customers are good. Don’t fall victim to customer counting. Instead, optimize for good customers and segment your activities based on the kinds of customer those activities attract.

E-commerce Key Metrics

Consider an online luxury goods store. Subscribers to the site get exclusive deals at reduced prices for items that are curated by the site’s operators. Visitors to the site can browse what’s available, but must sign up to place an order or put something in a shopping cart; by signing up, they agree to receive a daily email update. Visitors can also tweet or like something they see on the site.

The company cares about several key metrics:

- Conversion rate: The number of visitors who buy something.

- Purchases per year: The number of purchases made by each customer per year.

- Average shopping cart size: The amount of money spent on a purchase.

- Abandonment: The percentage of people who begin to make a purchase, and then don’t.

- Cost of customer acquisition: The money spent to get someone to buy something.

- Revenue per customer: The lifetime value of each customer.

- Top keywords driving traffic to the site: Those terms that people are looking for, and associate with you—a clue to adjacent products or markets.

- Top search terms: Both those that lead to revenue, and those that don’t have any results.

- Effectiveness of recommendation engines: How likely a visitor is to add a recommended product to the shopping cart.

- Virality: Word of mouth, and sharing per visitor.

- Mailing list effectiveness: Click-through rates and ability to make buyers return and buy.

E-commerce Key Metrics Explained

Conversion Rate

Conversion rate is simply the percentage of visitors to your site who buy something. It’s one of the first metrics you use to assess how you’re doing. It’s simple to calculate and experiment with. You’ll slice conversion rate in many ways—by demographics, by copy, by referral, and so on—to see what makes people more likely to buy.

Early on, conversion rate may even be more important than total revenue because your initial goal is to simply prove that someone will buy something (and it gives you that person’s email address and data on what he purchases). But there’s also a risk in focusing too intensely on conversion rate. Conversion rate is highly dependent on your type of e-commerce business, and whether your success will be driven by loyalty, new customer acquisition, or a hybrid of the two.

Purchases Per Year

If you look at the repurchase rate on a 90-day cycle, it becomes a very good leading indicator for what type of e-commerce site you have. There’s no right or wrong answer, but it is important to know whether to focus more on loyalty or more on acquisition.

Shopping Cart Size

The other half of the conversion rate equation is the size of the shopping cart. Not only do you want to know what percentage of people bought something, you also want to know how much they spent. You may find that one campaign is more likely to make people buy, but another might make fewer people spend more money.

In practice, you’ll compare the total revenue you’re generating to the way in which you acquired that revenue, in order to identify the most lucrative segments of your reachable audience. But don’t get too caught up in top-line revenue; profit is what really matters.

The key to successful e-commerce is in increasing shopping cart size; that’s really where the money is made. I like to think of customer acquisition cost as a fixed cost, so any increase in order size is expanding your margin.

Abandonment

The number of people who abandon a funnel at each of these stages is the abandonment rate. It’s important to analyze it for each step in order to see which parts of the process are hurting you the most. In some cases, this may be a particular form field—for example, asking people for their nationality could be alienating buyers. Tools like ClickTale perform abandonment analysis within the form itself, making it easier to pinpoint bottlenecks in the conversion process where you’re losing customers.

Cost of Customer Acquisition

Accounting for the cost of acquisition in aggregate is fairly easy; it’s more complicated when you have myriad channels driving traffic to your site. The good news is that analytics tools were literally built to do this for you. The reason Google has a free analytics product is because the company makes money from relevant advertising, and wants to make it as easy as possible for you to buy ads and measure their effectiveness.

Revenue Per Customer

Revenue per customer (or lifetime value) is important for all types of e-commerce businesses, regardless of whether you’re focused on new customer acquisition or loyalty (or both). Even if your business doesn’t engender loyalty (because you’re selling something that’s infrequently purchased), you want to maximize revenue per customer; you do so by increasing shopping cart size and conversion while reducing abandonment. Revenue per customer is really an aggregate metric of other key numbers, and represents a good, single measure of your e-commerce business’s health.

Keywords and Search Terms

Most people find products by searching for them, whether that’s in a web browser, on a search engine, or within a site. In each case, you want to know which keywords drive traffic that turns into money.

For paid search, you’re going to be bidding against others for popular keywords in search engines like Google. Understanding which words are a comparatively good “value”—not too expensive, but still able to drive a reasonable amount of traffic—is what search engine marketing professionals do for a living.

For unpaid search, you’ll be more focused on good, compelling content that improves your ranking with search engines, and on writing copy that includes the desirable search terms your paying customers tend to use (so you’ll be featured in search results because of your relevance).

You also want to analyze search within your site. First, you want to be sure you have what people are after. If users are searching for something and not finding it—or searching, then pressing the back button—that’s a sign that you don’t have what they want. Second, if a significant chunk of searches fall into a particular category, that’s a sign that you might want to alter your positioning, or add that category to the home page, to see if you can capture more of that market faster.

Recommendation Acceptance Rate

There are many different approaches to recommendations. Some use what the buyer has purchased in the past; others try to predict purchases from visitor attributes like geography, referral, or what the visitor has clicked so far. Predictive analysis of visitors relies heavily on machine learning, and the metrics you’ll track will vary from tool to tool, but they all boil down to one thing: how much additional revenue am I generating through recommendations?

Virality

For many e-commerce sites, virality is important, because referral and viral attention drives cheap, high-value traffic. It has the lowest cost of customer acquisition and the highest implied recommendation from someone the recipient trusts.

Mailing List Click-Through Rates

You calculate the email click-through rate by dividing the number of visits you get from a campaign by the number of messages you’ve sent. A more sophisticated analysis of email click-through rate will include a breakdown of the various places where things can go wrong—for example, what percentage of email addresses didn’t work anymore—and a look at the eventual outcome you’re after (such as a purchase).

You also need to create a campaign contribution metric—basically, the added revenue from the campaign, minus the cost of the campaign and the loss due to unsubscribes. The good news is that most email platforms include this data with minimal effort.

SaaS Key Metrics

Consider a project management startup that lets users try its product, but charges for more than three concurrent projects. It offers four tiers: free, 10 projects, 100 projects, and unlimited. It runs ads on several platforms to attract users to its site, and each time a user invites someone else to join a project, that person becomes a user.

The company cares about the following key metrics:

- Attention: How effectively the business attracts visitors.

- Enrollment: How many visitors become free or trial users, if you’re relying on one of these models to market the service.

- Stickiness: How much the customers use the product.

- Conversion: How many of the users become paying customers, and how many of those switch to a higher-paying tier.

- Revenue per customer: How much money a customer brings in within a given time period.

- Customer acquisition cost: How much it costs to get a paying user.

- Virality: How likely customers are to invite others and spread the word, and how long it takes them to do so.

- Upselling: What makes customers increase their spending, and how often that happens.

- Uptime and reliability: How many complaints, problem escalations, or outages the company has.

- Churn: How many users and customers leave in a given time period.

- Lifetime value: How much customers are worth from cradle to grave.

Describing a customer lifecycle in this way is a good method for understanding the key metrics that drive your business. This is where Lean Startup helps. You need to know which aspects of your business are too risky and then work to improve the metric that represents that risk.

You have to know where the risk is, but focus, in the right order, on just enough optimization to get the business to a place where that risk can be quantified and understood.

Measuring Engagement

The ultimate metric for engagement is daily use. How many of your customers use your product on a daily basis? If your product isn’t a daily use app, establishing a minimum baseline of engagement takes longer, and the time it takes to iterate through a cycle of learning is longer. It’s also hard to demonstrate enough value, quickly enough, to keep people from churning. Habits are hard to form—and with any new product, you’re creating new habits, which you want to do as quickly and intensely as possible.

There is an important lesson around business models and Lean Startup—you bring an early version of your product to the market, test its usage, and look for where it’s got the highest engagement among your customers. If there’s a subsection of users who are hooked on your product—your early adopters—figure out what’s common to them, refocus on their needs, and grow from there. Claim your beachhead. It will allow you to iterate much more quickly on a highly engaged segment of the market.

Some applications simply aren’t meant to be used on a daily basis. But you still need to set a high bar for engagement and measure against it. It’s critical that you understand customers’ behavior, and draw lines in the sand appropriate to that. Perhaps the goal is weekly or monthly use.

If you’re building something genuinely disruptive, you need to consider the technology adoption lifecycle, from early to mainstream.

When measuring engagement, don’t just look at a coarse metric like visit frequency. Look for usage patterns throughout your application. For example, it’s interesting to know that people log in three times per week, but what are they actually doing inside your application? What if they’re only spending a few minutes each time? Is that good or bad? Are there specific features they’re using versus others? Is there one feature that they always use, and are there others they never touch? Did they return of their own accord, or in response to an email?

Finding these engagement patterns means analyzing data in two ways:

- To find ways you might improve things, segment users who do what you want from those who don’t, and identify ways in which they’re different. Do the engaged users all live in the same city? Do all users who eventually become loyal contributors learn about you from one social network? Are the users who successfully invite friends all under 30 years old? If you find a concentration of desirable behavior in one segment, you can then target it.

- To decide whether a change worked, test the change on a subset of your users and compare that subset’s results to others. If you put in a new reporting feature, reveal it to half of your users, and see if more of them stick around for several months. If you can’t test features in this way without fallout—the customers who didn’t get the new feature might get angry—then at the very least, compare the cohort of users who joined after the feature was added to those who came before.

A data-driven approach to measuring engagement should show you not only how sticky your product or service is, but also who stuck and whether your efforts are paying off.

Calculating Churn

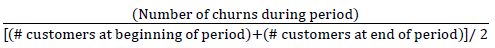

Churn is the percentage of people who abandon your service over time. This can be measured weekly, monthly, quarterly, etc., but you should pick a timespan for all your metrics and stick to it in order to make comparing them easier. While churn might seem like a simple metric, there are a number of complications that can make it misleading, particularly for companies that have a highly variable growth rate.

Unpaid users “churn” by cancelling their accounts or simply not coming back; paid users churn by cancelling their accounts, stopping their payments, or reverting to an unpaid version. We recommend defining an inactive user as someone who hasn’t logged in within 90 days (or less). At that point, they’ve churned out; in an always-connected world, 90 days is an eternity.

Churn Complications

Because the number of churns in a particular period is affected by the entire period, but the number of customers at the beginning of a period is a moment-in-time snapshot, calculating churn in this simple manner can give misleading results in startups where growth is varied or unusually fast. In other words, churn isn’t normalized for behavior and size—you can get different churn rates for the same kind of user behavior if you’re not careful.

To fix this, you need to calculate churn in a less simple, but more accurate, way: average out the number of customers in the period you’re analyzing, so you’re not just looking at how many you had at the beginning:

Ultimately, the math gets really complex. There are two ways to simplify it. The first is to measure churn by cohort, so you’re comparing new to churned users based on when they first became users. The second way is really, really simple, which is why we like it: measure churn each day. The shorter the time period you measure, the less that changes during that specific period will distort things.

SaaS Complexities

In a SaaS model, most of the complexity comes from two things: the promotional approach you choose, and pricing tiers.

As we’ve seen, some SaaS companies use a freemium model to convince people to use the service, and then make money when those users exceed some kind of cap. A second approach is a free trial, which converts to a paid subscription if the customer doesn’t explicitly cancel after a certain time. A third approach is paid-only. There are others. Each has its benefits and drawbacks—paid-only controls cost, is more predictable, and gives you an immediate idea of whether your offering is valuable; freemium allows you to learn how people are using your service and builds goodwill. The difference between these user groups can complicate analysis.

The second wrinkle comes from how you tier pricing. Since different customers have different levels of consumption, the price they pay may change over time. This means you’re constantly trying to upsell users to bigger tiers, and predicting growth adds to the dimensions of a model, making it harder to predict and explain your business.

Mobile App Monetization Options

Mobile app developers make money within their applications in several ways:

- Downloadable content (such as new maps or vehicles): Tower Madness, a popular Tower Defense game for the iPhone, sells additional map sets at a small cost.

- Flair and customization of in-character appearance and gaming content (a pet, clothing for a player’s avatar): Blizzard sells non-combat enhancements like pets or vanity mounts.

- Advantages (better weapons, upgrades, etc.): Draw Something charges for colors that make drawing easier.

- Saving time: A respawn rather than having to run a long distance, a strategy employed by many casual web-based MMOs.

- Elimination of countdown timers: Topping up energy levels that would normally take a day to refresh, which Please Stay Calm uses.

- Upselling to a paid version: Some applications constrain features. As of this writing, Evernote’s mobile application doesn’t allow offline synchronization of files unless a user has upgraded to the paid client, for example.

- In-game ads: Some games include in-game advertising, where the player watches promotional content in return for credits in the in-game currency.

Mobile App Key Metrics

- Downloads: How many people have downloaded the application, as well as related metrics such as app store placement, and ratings.

- Customer acquisition cost (CAC): How much it costs to get a user and to get a paying customer.

- Launch rate: The percentage of people who download the app, actually launch it, and create an account.

- Percent of active users/players: The percentage of users who’ve launched the application and use it on a daily and monthly basis: these are your daily active users (DAU) and monthly active users (MAU).

- Percentage of users who pay: How many of your users ever pay for anything.

- Time to first purchase: How long it takes after activation for a user to make a purchase.

- Monthly average revenue per user (ARPU): This is taken from both purchases and watched ads. Typically, this also includes application-specific information—such as which screens or items encourage the most purchases. Also look at your ARPPU, which is the average revenue per paying user.

- Ratings click-through: The percentage of users who put a rating or a review in an app store.

- Virality: On average, how many other users a user invites.

- Churn: How many customers have uninstalled the application, or haven’t launched it in a certain time period.

- Customer lifetime value: How much a user is worth from cradle to grave.

Media Sites Key Metrics

- Audience and churn: How many people visit the site and how loyal they are.

- Ad inventory: The number of impressions that can be monetized.

- Ad rates: Sometimes measured in cost per engagement—essentially how much a site can make from those impressions based on the content it covers and the people who visit.

- Click-through rates: How many of the impressions actually turn into money.

- Content/advertising balance: The balance of ad inventory rates and content that maximizes overall performance.

Calculating Churn for Media Sites

The most obvious metric for a media site is audience size. If we assume that an ad will get industry-standard click-through rates, then the more people who visit your site, the more money you’ll make.

Tracking the growth in audience size—usually measured as the number of unique visitors a month—is essential.

You can calculate audience churn on a media site by looking at the change in unique visitors in a specific month and the number of new visitors that month.

Inventory

Tracking unique visitors is a good start, but you need to measure ad inventory as well. This is the total number of unique page views in a given period of time, since each page view is a chance to show a visitor an ad. You can estimate inventory from visitors and pages per visit, but most analytics packages show the number automatically.

Ad Rates

The rate advertising networks will pay you for an ad depends on your content and the going rate for a particular search term or keyword. For a straight-up media site, the ad rate is driven by the topic of your site and the content you publish. For a social network, the demographics of your audience drive ad rates.

Content/Advertising Trade-off

The big decision any media site makes is how to pay the bills without selling out. This manifests itself in two ways. First, ad space: too many ads leads to lousy content and reduced visitor loyalty. Second, content: if your content is written to attract lucrative ad keywords, it’ll feel forced and seem like a paid promotion.

If you’re serious about content, you need to test different layouts for revenue-versus-churn, and different copy for content-versus-ad-value.

There are commercial tools to help with this. Parse.ly, for example, tries to analyze which content is getting the most traction. You might also segment key metrics like revenue or percentage of visitors who exit on a particular page by author, topic, or layout.

User-Generated Content Site’s Key Metrics

- Number of engaged visitors: How often people come back, and how long they stick around.

- Content creation: The percentage of visitors who interact with content in some way, from creating it to voting on it.

- Engagement funnel changes: How well the site moves people to more engaged levels of content over time.

- Value of created content: The business benefit of content, from donations to media clicks.

- Content sharing and virality: How content gets shared, and how this drives growth.

- Notification effectiveness: The percentage of users who, when told something by push, email, or another means, act on it.

Visitor Engagement

A UGC site is successful when its visitors become regulars. We look at recency to understand this—that is, when was the last time someone came back to the site? One quick way to measure this is the day-to-week ratio: how many of today’s visitors were here earlier in the week? It’s an indicator of whether people are returning on a regular basis, even if users don’t create an account.

Another metric is the average days since last visit, although you need to exclude users who are beyond some cutoff limit (such as 30 days) from this calculation; otherwise, churned users will skew your numbers. For users who have accounts and take actions, you can measure engagement in other ways: days since last post, number of votes per day, and so on.

Value of Created Content

The content your users create has a value. That might be the number of unique visitors who see it (in the case of a site like Wikipedia), the number of page views that represent ad inventory (Facebook), or a more complicated measurement like affiliate revenues generated by clicks on content users post (as in the Pinterest affiliate model).

Regardless of how you value content, you’ll want to measure it by cohort or traffic segment. If you’re trying to decide where to invest in visitor acquisition, you’ll want to know which referring sites bring valuable users.

Content Sharing and Virality

A UGC site thrives on its visitors’ behavior, and key among those behaviors is sharing.

While tweeting and liking content is useful, remember that a lot of sharing happens through other systems—RSS feeds and email, in particular. In fact Tynt, which makes tools for publishers to tag sharing when a link is copied and pasted, estimates that as much as 80% of sharing happens through email.

User-Generated Content Site’s Key Takeaways

- Visitor engagement is everything in UGC. You track visitors’ involvement in an “engagement funnel.”

- Many users will lurk, some will contribute lightly, and others will become dedicated content creators. This 80/20 split exists throughoutthe activities you want your users to accomplish.

- To keep users coming back and engaged, you’ll need to notify them of activity through email and other forms of “interruption.”

- Fraud prevention is a significant amount of work for a UGC site.

Marketplaces Definition

In a marketplace, the company makes money when a buyer and seller come together to complete a transaction.

A marketplace includes a shared inventory model and two stakeholders—buyers and sellers, creators and supporters, prospective partners, or hotels and travellers. They all make money when the two stakeholders come together, and they often differentiate based on a particular set of search parameters or qualifications (e.g., apartments that have been vetted, seller ratings). And they all need an inventory to get started.

We’re going to define two-sided marketplaces more narrowly. In our definition:

- The seller is responsible for listing and promoting the product. A real estate service that simply publishes realtor listings wouldn’t qualify, but a for-sale-by-owner site would.

- The marketplace owner has a “hands off” approach to the individual transactions. Sites like Hotwire that create the hotel profiles wouldn’t be included.

- The buyer and seller have competing interests. In most marketplace models the seller wants to extract as much money as possible, while the buyer wants to spend as little as possible. In a dating site, regardless of gender differences, both parties have a shared interest—a compatible partner—so we’ll leave them out of this discussion.

Two-sided marketplaces face a unique problem: they have to attract both buyers and sellers. That looks like twice as much work. Companies like DuProprio/Comfree, Etsy, Uber, and Amazon found ways around this dilemma, but they all boil down to one thing: focus on whomever has the money. Usually, that’s buyers: if you can find a group that wants to spend money, it’s easy to find a group that wants to make money.

Starting a Marketplace

Imagine you’re launching a two-sided marketplace for secondhand game consoles. Those with a console to sell can list it, and those looking for a console to buy can browse by a variety of criteria. The transactions are handled through PayPal, and you retain a portion of the proceeds above a minimum amount.

Because you’re not a vendor of consoles yourself, you need to find a way to produce either an inventory of consoles, or a large group of customers. You need to pick which side of the market you’re going to “seed.”

If you want to seed the seller side, you might crawl Craigslist and approach console owners to see if they have inventory, encouraging them to list items. If you want to seed the buyer side, you might set up a forum for nostalgic game players, bringing them together and inviting them from social sites.

You could create an artificial inventory by selling consoles to start with, and then gradually adding inventory from others.

On the other hand, if you want to seed the buyer side, you probably need to pick something for which you can command an initial inventory, then purchase some; or you might take orders with a promise of fulfilling them later, knowing you have access to that inventory.

The first step of a two-sided marketplace—and the first thing to measure—is your ability to create an inventory (supply) or an audience (demand). The metrics you’ll care about first are around the attraction, engagement, and growth of this seed group.

Josh Breinlinger, a venture capitalist at Sigma West who previously ran marketing at labor marketplace oDesk, breaks up the key marketplace metrics into three categories: buyer activity, seller activity, and transactions. “I almost always recommend modeling the buyer side as your primary focus, and then you model supply, more in the sense of total inventory,” he says. “It’s easy to find people that want to make money; it’s much harder to find people that want to spend money.”

Josh cautions that just tracking buyer, seller, and inventory numbers isn’t enough: you have to be sure those numbers relate to the actual activity that’s at the core of your business model.

Once you’ve got both sides of the market together, your attention (and analytics) will shift to maximizing the proceeds from the market—the number of listings, the quality of buyers and sellers, the percentage of searches for which you have at least one item in inventory, the marketplace specificmetrics Josh mentions, and ultimately, the sales volume and resulting revenue. You’ll also focus on understanding what makes a listing desirable so you can attract more like it. And you’ll start tracking fraud and bad offerings that can undermine the quality of the marketplace and send buyers and sellers away.

Marketplaces Key Metrics

- Buyer and seller growth: The rate at which you’re adding new buyers and sellers, as measured by return visitors.

- Inventory growth: The rate at which sellers are adding inventory—such as new listings— as well as completeness of those listings.

- Search effectiveness: What buyers are searching for, and whether it matches the inventory you’re building.

- Conversion funnels: The conversion rates for items sold, and any segmentation that reveals what helps sell items.

- Ratings and signs of fraud: The ratings for buyers and sellers, signs of fraud, and tone of the comments.

- Pricing metrics: If you have a bidding method in place (as eBay does), then you care whether sellers are setting prices too high or leaving money on the table.

Rate at Which You’re Adding Buyers and Sellers

This metric is particularly important in the early stages of the business. If you’re competing with others, then your line in the sand is an inventory of sellers that’s comparable to that of your competitors, so it’s worth a buyer’s time to search you. If you’re in a relatively unique market, then your line in the sand is enough inventory that buyers’ searches are returning one or more valid results.

Rate of Inventory Growth

In addition to sellers, you need to track listings they create. Focus on the number of listings per seller and whether that’s growing, as well as the completeness of those listings (are sellers completing the description of their offering?).

A bigger inventory means more searches are likely to yield results. If you start to saturate your marketplace (i.e., if most of the sellers in your market have already become members), then your growth will come from increasing their listings and the effectiveness of those listings.

Buyer Searches

In many two-sided markets, searches are the primary way in which buyers find sellers. You need to track the number of searches that return no results—this is a lost sales opportunity.

You should also look at the search terms themselves. By looking at the most common search terms that yield nothing, you’ll find out what your buyers are after.

Marketplaces Key Takeaways

- Two-sided markets come in all shapes and sizes.

- Early on, the big challenge is solving the “chicken and egg” problem of finding enough buyers and sellers. It’s usually good to focus on the people who have money to spend first.

- Since sellers are inventory, you need to track the growth of that inventory and how well it fits what buyers are looking for.

- While many marketplaces take a percentage of transactions, you may be able to make money in other ways, by helping sellers promote their products or charging a listing fee.

Defining the 5 Stages of a Startup

Every startup goes through stages, beginning with problem discovery, then building something, then finding out if what was built is good enough, then spreading the word and collecting money. These stages—Empathy, Stickiness, Virality, Revenue, and Scale—closely mirror what other Lean Startup advocates advise.

- First, you need empathy. You need to get inside your target market’s head and be sure you’re solving a problem people care about in a way someone will pay for. That means getting out of the building, interviewing people, and running surveys.

- Second, you need stickiness, which comes from a good product. You need to find out if you can build a solution to the problem you’ve discovered. There’s no point in promoting something awful if your visitors will bounce right off it in disgust. Companies like Color that attempted to scale prematurely, without having proven stickiness, haven’t fared well.

- Third, you need virality. Once you’ve got a product or service that’s sticky, it’s time to use word of mouth. That way, you’ll test out your acquisition and onboarding processes on new visitors who are motivated to try you, because you have an implied endorsement from an existing user. Virality is also a force multiplier for paid promotion, so you want to get it right before you start spending money on customer acquisition through inorganic methods like advertising.

- Fourth, you need revenue. You’ll want to monetize things at this point. That doesn’t mean you haven’t already been charging—for many businesses, even the first customer has to pay. It just means that earlier on, you’re less focused on revenue than on growth. You’re givin away free trials, free drinks, or free copies. Now you’re focused on maximizing and optimizing revenue.

- Fifth, you need scale. With revenues coming in, it’s time to move from growing your business to growing your market. You need to acquire more customers from new verticals and geographies. You can invest in channels and distribution to help grow your user base, since direct interaction with individual customers is less critical—you’re past product/market fit and you’re analyzing things quantitatively.

Metrics for the Empathy Stage

In the Empathy stage, your focus is on gathering qualitative feedback, primarily through problem and solution interviews. Your goal is to find a problem worth solving and a solution that’s sufficiently good to garner early traction. You’re collecting this information by getting out of the building. If you haven’t gotten out of the building enough—and spoken to at least 15 people at each interviewing stage—you should be very concerned about rushing ahead.

Early on, you’ll keep copious notes. Later, you might score the interviews to keep track of which needs and solutions were of the greatest interest, because this will tell you what features need to be in your minimum viable product (MVP).

The Importance of Qualitative Metrics

Qualitative metrics are all about trends. You’re trying to tease out the truth by identifying patterns in people’s feedback. You have to be an exceptionally good listener, at once empathetic and dispassionate. You have to be a great detective, chasing the “red threads” of the underlying narrative, the commonalities between multiple interviewees that suggest the right direction. Ultimately, those patterns become the things you test quantitatively, at scale. You’re looking for hypotheses.

The reality of qualitative metrics is that they turn wild hunches—your gut instinct, that nagging feeling in the back of your mind—into educated guesses you can run with. Unfortunately, because they’re subjective and gathered interactively, qualitative metrics are the ones that are easiest to fake.

While quantitative metrics can be wrong, they don’t lie. You might be collecting the wrong numbers, making statistical errors, or misinterpreting the results, but the raw data itself is right. Qualitative metrics are notoriously easy for you to bias. If you’re not ruthlessly honest, you’ll hear what you want to hear in interviews. We love to believe what we already believe— and our subjects love to agree with us.

How To Measure User’s Pain

A simple approach is to score your problem interviews. This is not perfectly scientific; your scoring will be somewhat arbitrary, but if you have someone assisting you during the interviews and taking good notes it should be possible to score things consistently and get value out of this exercise.

For the purposes of scoring the interview and measuring pain, a bad score means the interview is a failure—the interviewee’s pain with the problems you’re considering isn’t substantial enough if she spends all her time talking about other problems she has. A failed interview is OK; it may lead you to something even more interesting and save you a lot of heartache.

The more effort the interviewee has put into trying to solve the problems you’re discussing, the better.

Ideally, your interviewees were completely engaged in the process: listening, talking (being animated is a good thing), leaning forward, and so on. After enough interviews you’ll know the difference between someone who’s focused and engaged, and someone who is not.

The goal of the problem interview is to discover a problem painful enough that you know people want it solved. And ideally, the people you’re speaking to are begging you for the solution. The next step in the process is the solution interview, so if you get there with people that’s a good sign.

At the end of every interview, you should be asking for referrals to other interviewees. There’s a good chance the people your subjects recommend are similar in demographics and share the same problems.

The best-case scenario is very high interview scores within a subsection of interviewees where those interviewees all had the same (or very similar) rankings of the problems. That should give you more confidence that you’ve found the right problem and the right market.

A Summary of the Empathy Stage

- Your goal is to identify a need you can solve in a way people will pay money for at scale. Analytics is how you measure your way from your initial idea to the realization of that goal.

- Early on, you conduct qualitative, exploratory, open-ended discussions to discover the unknown opportunities.

- Later, your discussions become more quantitative and more convergent, as you try to find the right solution for a problem.

- You can use tools to get answers at scale and build up an audience as you figure out what product to build.

The Importance Stickiness

The focus now is squarely on retention and engagement. You can look at daily, weekly, and/or monthly active users; how long it takes someone to become inactive; how many inactive users can be reactivated when sent an email; and which features engaged users spend time with, and which they ignore. Segment these metrics by cohort to see if your changes convince additional users to behave differently. Did users who signed up in February stick around longer than those who joined in January?

You don’t just want signs of engagement. You want proof that your product is becoming an integral part of your users’ lives, and that it’ll be hard for them to switch. You’re not looking for, nor should you expect, rapid growth. You’re throwing things at the wall to test stickiness, not measuring how fast you can throw. And by “things,” we mean users. After all, if you can’t convince a hundred users to stick around today, you’re unlikely to convince a million to do so later.

Your top priority is to build a core set of features that gets used regularly and successfully, even by a small group of initial users. Without that, you don’t have a solid enough foundation for growth. Your initial target market can be very small, hyper-focused on the smallest subset of users that you think will generate meaningful results.

Ultimately, you need to prove two things before you can move on to the Virality stage:

- Are people using the product as you expected? If they aren’t, maybe you should switch to that new use case or market, as PayPal did when it changed from PalmPilot to web-based payment or when Autodesk stopped making desktop automation and instead focused on design tools.

- Are people getting enough value out of it? They may like it, but if they won’t pay, click ads, or invite their friends, you may not have a business.

Don’t drive new traffic until you know you can turn that extra attention into engagement. When you know users keep coming back, it’s time to grow your user base.

The Goal is Retention

The more engaged that people are with your product (and potentially other users of your product), the more likely they’ll stay. By ignoring growth from virality (for now), you can simplify how you decide what to build next into your MVP. Ask yourself, “Do we believe that the feature we want to build (or the feature we want to change) will improve stickiness?” Put the feature aside if the answer is “no.” But if the answer is “yes,” figure out how to test that belief and start building the feature.

A Summary of the Stickiness Stage

- Your goal is to prove that you’ve solved a problem in a way that keeps people coming back.

- The key at this stage is engagement, which is measured by the time spent interacting with you, the rate at which people return, and so on. You might track revenue or virality, but they aren’t your focus yet.

- Even though you’re building the minimal product, your vision should still be big enough to inspire customers, employees, and investors— and there has to be a credible way to get from the current proof to the future vision.

- Don’t step on the gas until you’ve proven that people will do what you want reliably. Otherwise, you’re spending money and time attracting users who will leave immediately.

- Rely on cohort analysis to measure the impact of your continuous improvements as you optimize the stickiness of your product.

Should You Move to the Next Stage?

- Are people using the product as expected?

- If they are, move to the next step.

- If they aren’t, are they still getting enough value out of it, but using it differently? Or is the value not there?

- Define an active user. What percentage of your users/customers is active? Write this down. Could this be higher? What can you do to improve engagement?

- Evaluate your feature roadmap against our seven questions to ask before building more features. Does this change the priorities of feature development?

- Evaluate the complaints you’re getting from users. How does this impact feature development going forward?

Metrics for the Viral Phase

Measuring your viral growth turns out to be really important if you don’t want to pay for customers. The number you’re after is your viral coefficient, which venture capitalist David Skok sums up nicely as “the number of new customers that each existing customer is able to successfully convert.”

To calculate your viral coefficient:

- First calculate the invitation rate, which is the number of invites sent divided by the number of users you have.

- Then calculate the acceptance rate, which is the number of signups or enrollments divided by the number of invites.

- Then multiply the two together.

There’s another factor to consider here: cycle time. If it takes only a day for someone to use the site and invite others, you’ll see fast growth. On the other hand, if it takes someone months before she invites others, you’ll see much slower growth.

Cycle time makes a huge difference—so much so, David feels it’s more important than viral coefficient.

Ultimately, what we’re after is a viral coefficient above 1, because this means the product is self-sustaining. With a viral coefficient above 1, every single user is inviting at least another user, and that new user invites another user in turn. That way, after you have some initial users your product grows by itself. In the preceding example, we could do several things to push the viral coefficient toward 1:

- Focus on increasing the acceptance rate.

- Try to extend the lifetime of the customer so he has more time to invite people.

- Try to shorten the cycle time for invitations to get growth faster.

- Work on convincing customers to invite more people.

What Makes a Good Leading Indicator

Good leading indicators have a few common characteristics:

- Leading indicators tend to relate to social engagement (links to friends), content creation (posts, shares, likes), or return frequency (days since last visit, time on site, pages per visit).

- The leading indicator should be clearly tied to a part of the business model (such as users, daily traffic, viral spread, or revenue). After all, it’s the business model that you’re trying to improve. You’re not just trying to increase number of friends per user—you’re trying to increase the number of loyal users.

- The indicator should come early in the user’s lifecycle or conversion funnel. This is a simple numbers game: if you look at something that happens on a user’s first day, you’ll have data points for every user, butif you wait for users to visit several times, you’ll have fewer data points (since many of those users will have churned out already), which means the indicator will be less accurate.

- It should also be an early extrapolation so you get a prediction sooner. Kevin Hillstrom says the best way to understand whether an e-commerce company is a “loyalty” or an “acquisition”-focused organization is to look at how many second purchases happen in the first 90 days. Rather than wait a year to understand what mode you’re in, look at the first three months and extrapolate.

You find leading indicators by segmentation and cohort analysis. Looking at one group of users who stuck around and another group who didn’t, you might see something they all have in common.

A Summary of the Virality Stage

- Virality refers to the spread of a message from existing, “infected” users to new users.

- If every user successfully invites more than one other user, your growth is almost assured. While this is seldom the case, any word of mouth adds to customer growth and reduces your overall customer acquisition costs.

- Inherent virality happens naturally as users interact with your product. Artificial virality is incentivized and less genuine. And word of mouth, while hard to create and track, drives a lot of early adoption. You need to segment users who come from all three kinds of virality.

- In addition to viral coefficient, you care about viral cycle time. The sooner each user invites another one, the faster you’ll grow.

- As you grow in the Virality and Revenue stages, you’re trying to find leading indicators of future growth: metrics that can be measured early in a user’s lifecycle that predict—or, better yet, control—what the future will be.

Should You Move to the Next Stage?

Ask yourself these questions:

- Are you using any of the three types of virality (inherent, artificial, word of mouth) for your startup? Describe how. If virality is a weak aspect of your startup, write down three to five ideas for how you could build more virality into your product.

- What’s your viral coefficient? Even if it’s below 1 (which it likely is), do you feel like the virality that exists is good enough to help sustain growth and lower customer acquisition costs?

- What’s your viral cycle time? How could you speed it up? What are the segments or cohorts of users who do what your business model wants them to do? What do they have in common? What can you change about your product, market, pricing, or another aspect of your business to address this as early as possible in their customer lifecycle?

Finding The Revenue

At this stage in your startup, you’ve got a product that users like and tell other users about. In the Revenue stage, you need to figure out which “more” increases your revenues per engaged customer the most:

- If you’re dependent on physical, per-transaction costs (like direct sales, shipping products to a buyer, or signing up merchants), then more efficiently will figure prominently on either the supply or demand side of your business model.

- If you’ve found a high viral coefficient, then more people makes sense, because you’ve got a strong force multiplier added to every dollar you pour into customer acquisition.

- If you’ve got a loyal, returning set of customers who buy from you every time, then more often makes sense, and you’re going to emphasize getting them to come back more frequently.

- If you’ve got a one-time, big-ticket transaction, then more money will help a lot, because you’ve got only one chance to extract revenue from the customer and need to leave as little money as possible on the table.

- If you’re a subscription model, and you’re fighting churn, then upselling customers to higher-capacity packages with broader features is your best way of growing existing revenues, so you’ll spend a lot of time on more stuff.

The Breakeven Lines in the Sand

Revenue is not the only financial metric that matters. You want to be breakeven—meaning your revenues exceed your costs on a regular basis.

This means looking at business metrics such as operating costs, marginal costs, and so on. You may discover that it’s a good idea to fire a segment of your customers because of the drain they represent on the business—this is particularly true in B2B startups. With that in mind, here are some possible “gates” you may want to use to decide if you’re ready to move to the Scale stage.

Metrics for the Scale Stage

This stage is where you look beyond your own company. If you focus too early on competitors, you can be blinded by what they’re doing, rather than learning what your customers actually need.

In the Scale stage, you want to compare higher-order metrics like Backupify’s OMTM—customer acquisition payback—across channels, regions, and marketing campaigns. For example: is a customer you acquire through channels less valuable than one you acquire yourself? Does it take longer to pay back direct sales or telemarketing? Are international revenues hampered by taxes? These are signs that you won’t be able to scale independent of your own organizational growth.

A Summary of the Scale Stage

- When you’re scaling, you know your product and your market. Your metrics are now focused on the health of your ecosystem, and your ability to enter new markets.

- You’ll look at compensation, API traffic, channel relationships, and competitors at this stage—whereas before, these were distractions.

- You need to understand if you’re focused on efficiency or differentiation. Trying to do both as a way of scaling is difficult. If you’re efficiencyfocused, you’re trying to reduce costs; if you’re differentiation-focused, you’re increasing margins.

- As you grow, you’ll need to have more than one metric at a time. Set up a hierarchy of metrics that keeps the strategy, the tactics, and the implementation aligned with a consistent set of goals. We call this the three threes.

You never really leave the Scale stage, although as your organization becomes more and more like a “big company” you may find yourself having a hard time innovating. Congratulations—you’re now an intrapreneur, fighting the status quo and trying to change things from within.