It may be challenging to secure remote jobs as a freelance writer, but it can also get tricky when it’s time to receive payments. You’ve pitched to the client, delivered some top-quality content, and now it’s time to discuss your remunerations for the task. But that aspect of the transaction can be a little intimidating sometimes, especially if you’re new to freelancing.

Fortunately, working independently allows you to choose how and when your customers pay you. It’s one of the best things about freelancing and remote work, although most people tend to leave it out of their remote workforce definition.

But regardless of your preferred payment method, you first need to notify the customer about the fees. Crucially, you must send a clear, concise and informative message letting the client know how much they owe you, otherwise known as “invoicing.”

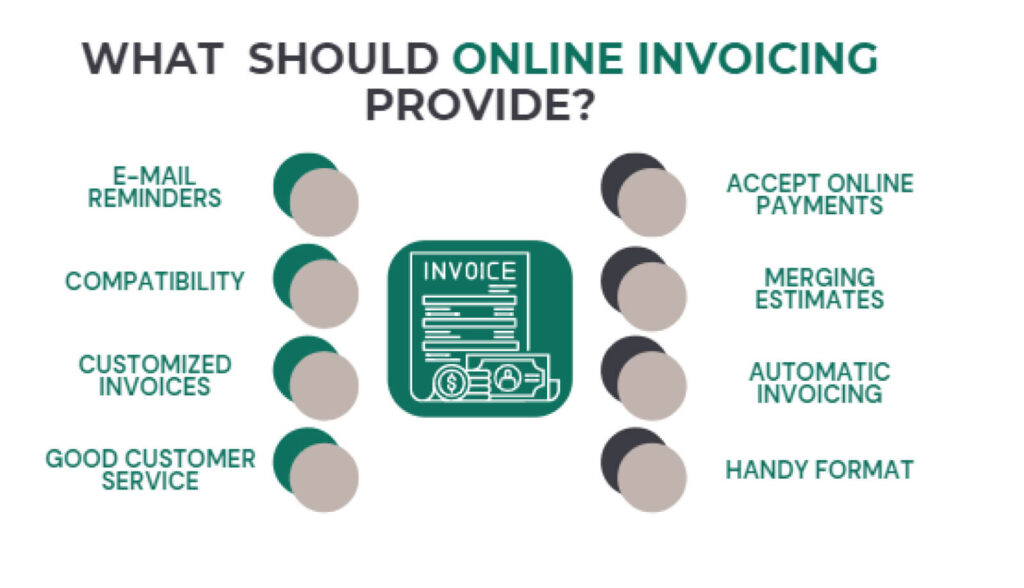

Online Invoicing Fundamentals

Initially, invoices were physical documents itemizing the components of a transaction and how they contribute to the overall fee. However, the growth of online transactions featuring e-payment methods has caused invoicing methods to evolve. Enter online invoicing, an evolved system necessary to ensure writers interested in freelancing receive proper compensation when due.

If you’ve been freelancing on marketplaces like Fiverr and Upwork, you’ve already been using online invoices. The reason why you might not have noticed is that the system does the hard work.

For instance, Fiverr allows freelancers to create gigs using a preset financial proposal template that sets your rates and expected service.

Image created by the author.

How Invoicing Works Online

Online or e-invoicing is the same as offline invoicing; the only difference is in the medium of administration. Traditional invoicing involves typing or writing the transaction details on a specifically-designed paper. However, you only need to email your client a document containing the transacted items or send it via other electronic means with online invoicing.

This online system is perfect for freelancers who need a way to track their dealings with clients and provide the details of all their transactions when it’s payment time.

A freelancer working outside of online marketplaces is in charge of their own invoicing. You decide the payment method, the right bank for your freelancing needs, and the best way to communicate transaction details to the client.

Here are the benefits of online invoicing and payments:

Save Money on Printing Invoice Slips

You don’t have to spend money designing and printing invoice slips. That way, you prevent unnecessary paper and resource wastage. Plus, it helps you to do your part in preserving trees and the general environment.

Seamless Storage and Tracking

The internet is a safer storage space than most offline catalogs. You can hardly lose anything once you put it securely online.

Consequently, there’s less risk of data loss on the internet. Plus, it’s easier to keep records, track your invoices and monitor the client’s response.

Automation

Online invoicing isn’t as tiresome as the traditional method. You can easily automate processes and get rid of menial tasks.

For example, you can use programs that automatically generate invoices once you list the elements of any deliverable.

Interestingly, some online software can also record, archive, and send invoices for you. With the right software, you won’t even need to think about creating or sending the invoice to your client.

Or multiple software, for that matter. You may have different frameworks to do each of those tasks and still make them work together. You might use software integration tools to connect the processes of each system such that once one completes its task, the other takes it up from there.

Ultimately, automation could save you a lot of time, depending on your invoicing needs, so it might be worth shopping around automation software that could help you.

How to Create an Online Invoice

Fundamentally, your invoice lists all the items of your transaction with a client. But that doesn’t mean an invoice only features the services delivered to your freelance client.

Below are the fundamentals you should include in your personalized online invoice.

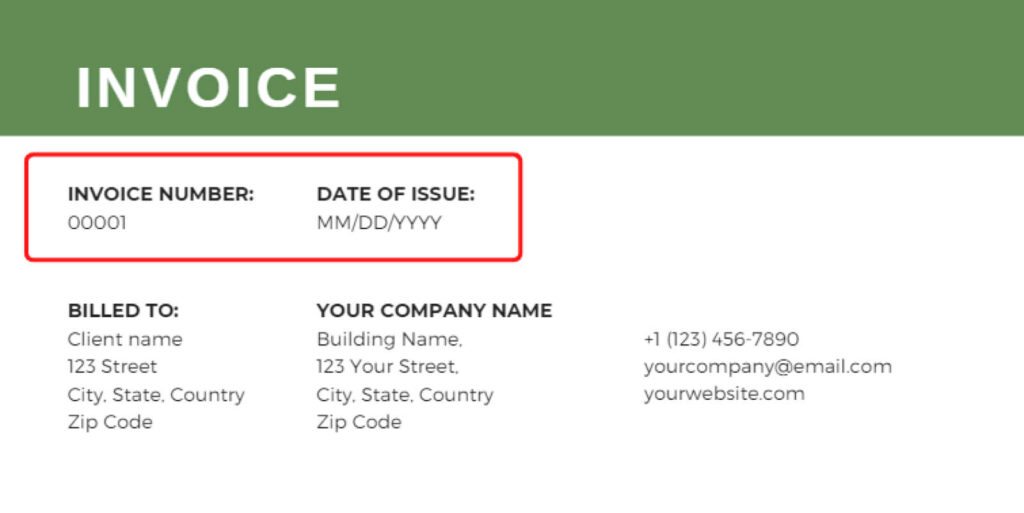

An Appropriate Header

A header featuring your brand logo or name should be at the top of your invoice. This specific location is because it serves as an identifier for your brand. Therefore, it should be the first thing anyone reading the document should see.

Underneath the header, you should clearly define the document. For example, you can easily write “invoice” in bold letters.

If you have a numbering system for your invoices, underneath the header is the place to introduce it. For instance, your first invoice might read “Invoice 0001.”

Finally, the header can introduce a color scheme that sets the tone for the rest of your invoice. Green is a popular choice, as it’s symbolically aligned with freshness and vitality as well as money, making it very appropriate for an invoice. But you can also check out some design blogs for inspiration.

Your Contact Information

While the clients may already know how to contact you, they may not be the ones to pay you. For example, picture a situation where your client has a joint venture agreement with an accounting company. In all likelihood, someone at the accounting company may want to reach you for inquiries while processing your invoice.

It’s recommended to include your contact information on your invoice. And, of course, you can be flexible and creative with how you present your contact details on your invoice.

For example, you can write it at the top of the document above the transaction details. Or you can note it at the bottom after the transaction details section.

Invoice Number and Date

Invoice number and date are essential referential points on an invoice. In addition, they enable easy recordkeeping and faster invoice processing.

It’s often more acceptable to cite the invoice number and date nearer to the top of the document. That’s because it makes them easier to locate and reference.

Image created by the author.

Client’s Contact Information

Like traditional invoicing, you should include the customer’s name, address, and other contact details on the invoice. Since you’re sending it to their emails, this may seem like an unnecessary addition. However, including the customer’s details assures the receiver that you’re addressing the invoice to them.

Transaction details

The bulk of the invoice is here. It’s the section where you include the goods or service description concisely.

In the form of a table, mention each deliverable, including the cost per unit alongside each one. If you charge hourly or per milestone, specify the number of hours or milestones you completed.

Finally, summarize the numbers and indicate the total visibly beneath the section. Doing so makes it easy for clients to scan the document and process your invoice without delay.

Payment Terms

Your invoice should also include the conditions applicable to the transaction and payment. For example, you can include conditions like payment due date, late payment charges, cancellation fees, and other pertinent information.

You can avoid being left chasing payment every month by including conditions like “late payment charges” in your invoice. Doing so might encourage clients to pay faster.

Of course, ensure that the buyer was aware of those conditions in your original contract before agreeing on the deal with you. Including conditions outside the original client agreement can delay invoice processing.

Available Payment Method

This section is where you specify how you want to receive the payment. Payment options for freelancers exist by the dozen making it essential to specify which you want the payer to use.

Indicate your preferred payment platform where necessary, including user ID or account info. For example, you can input your bank account details, PayPal account, Venmo, cash app, or any other method you’d like to use for receiving the payment.

Again, it helps if you have agreed on the payment platform with the buyer beforehand. This way, you can avoid payment delays arising from clients unable to use the payment platforms you choose.

How and When to Send an Online Invoice

The easiest way to send an online invoice is via email in PDF format. So, you should use that method unless the buyer prefers other methods. In this scenario, the preferred method for the buyer is the best option.

The best time to submit your invoice depends on your arrangements with the client. For example, if you did a one-time project for the client, it’s best to send the invoice after completing the task.

However, if it’s an ongoing task, it’s best to send the invoices periodically. That can be monthly, weekly, or quarterly, depending on your agreement with the customer.

The Right Template Makes Invoicing Effortless

A template should put you on the right track if you’re having problems with online invoicing, And if you don’t want to use random ones, you can create one for your brand.

Compared to other business documents, for instance, a release of liability template, online invoice templates are easy to create. Include all the elements described above, and you’re good to go!

About the Author

Yauhen Zaremba is the Senior Director of Demand Generation at PandaDoc. Yauhen is a growth-focused market leader with more than 14 years of B2B and B2C marketing experience. For the past seven years, he has focused entirely on the electronic signature, proposal, and document management markets.